Friday's Features: Using Attensity Analyze 6.0 To Compare Customer Sentiment For @united @southwestair @virginamerica

A Travelers' Tale of Two Airlines (@united vs @southwestair)

A hurried shower, followed by a hastily packed bag. Then, the race to the taxi stand (Figure 1). Should be easy to get a cab at 5:45 am in Las Vegas, right? Only the late night crew roll into a casino this late or early in the morning on a Tuesday. Who'd be flying out so early? So much for that theory. A line forms 50 deep outside. Eveyone is half asleep, and headed to McCarran - Las Vegas airport from Caesar's Palace at 5:30 am. I figure Southwest 2286 takes off at 6:25 am, should be plenty of time. I keep consoling myself. At 5:50, I get into my cab. I instruct the driver not to take the freeway and to go local.

Figure 1. Just Another Day At The Las Vegas Taxi Stand

I get to the self-service kiosk to check in. I get the dreaded <DING!>. I'm told my bag will be checked late and it could risk being sent on a later flight. At 6:00, I've missed all normal cut-off windows. Most airlines cut you off at 30 minutes prior and I am really late. I'm ready to accept my fate. I'm ready to be told to get on the next flight. Strangely enough, the gate agent notices that I'm late and does everything to hurry me on-board. She tells me that there is a chance my bag won't make it but they'll do their best. She kindly reminds me check-in is 30 minutes prior and suggests I take another security entrance to improve my odds of passing through TSA in time. She also lets me know that she's told the gate agent I may be late. I finally get through TSA and get to the gate with 2 minutes to spare. The aircraft door isn't closed. In fact, it's open and waiting for me to board. I hop on, pass out, and arrive in San Jose. In some modern day miracle, the bag also has arrived with me. I thank the travel gods.

Flash back one week earlier, the same morning sequence occurs in Las Vegas. This time with rental car in tow, I head to the rental car return center at 4:00am for a 5:30 am flight. A staffing issue occurs with the "consolidated rental center transportation" and no buses arrive until 4:30 am. I think to myself, I still have time. I rush to catch United Airlines 479 to San Francisco. The bus arrives at 4:45 am. I rush to the kiosk and arrive for check-in at 4:47 am. The kiosk tells me to see an agent. I wait another 3 minutes in the uber premium line (a.k.a. Global Services). The agent looks at my ticket and tells me in a stern and disapproving voice, I have to wait for the next flight which is at 11:49 am.

I flash my Global Services card in a last ditch attempt for empathy. The agent tells me that policy is policy. United can't check me in as I miss the cut-off. She tells me that I should know better and come to the airport earlier. The Las Vegas airport is so big, the bag would never get to the plane on time. They won't let me take off without my bag. There's no point in arguing at this point. I have a speech at 11:00 am to get to. I rush over to the Southwest counter to find the next flight. The agent asks me what's wrong. I tell her I need to get on the 6:30 am. She says, no problem. I give her all the details and she issues me a ticket in 5 minutes. I make it to the keynote but I'm very bitter about United and how they have treated me. I was a happy Continental flyer before the merger, you can read all about it here.

Social Data Quantifies Qualitative Experiences - United Ranks Last Among The Three Carriers

By now, most folks have seen what happened when "United Breaks Guitars", the tale of an awful customer experience for Dave Carroll who had his guitar broken. When the airline failed to take responsibility, he took to the web. With over 11.9M views as of this blog post, this social media epic fail epitomizes what happens when companies ignore their customers and shirk responsibility for resolving legitimate complaints. But what happens when an airline completely chooses to ignore social media as a channel? Do customers go away? Do they just jump to another channel? Are these social analytics tools reflective of the general customer base?

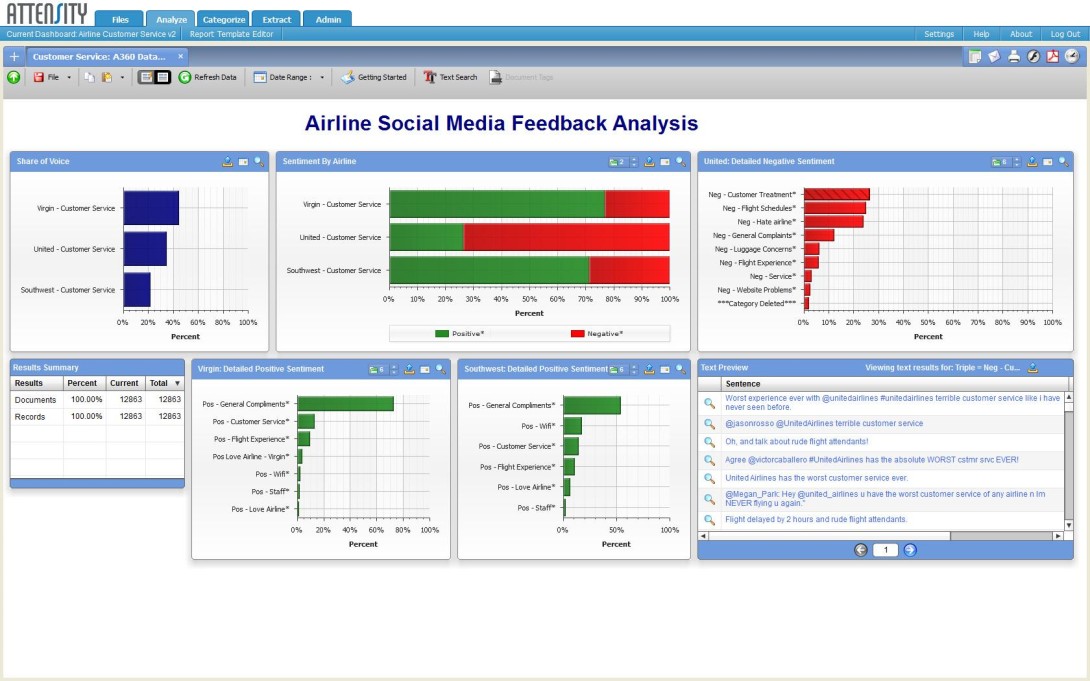

Using Attensity Analyze 6.0, a comparison was made among the three airlines. We selected two best in class low cost carriers (i.e. Southwest Airlines and Virgin America) and United Airlines to answer this question (Figure 1). Analyze 6.0 took 12,863 public comments from Facebook, Twitter, blogs, forums (user forums, discussion forums, LinkedIn Answers, etc) YouTube videos, mainstream news and more to gather this data (see Figure 2).

Figure 1. Twitter Accounts For The Three Airlines

Figure 2. Attensity's Analyze 6.0 In Action With Feedback Analysis On Three Select Airlines

In the social media feedback analysis, the Attensity Analyze report measured 3 major performance indicators:

- Share of voice. At about 40%, the bulk of the mentions come from Virgin America, with United at about 35%, and Southwest a bit over 20% in category share. Virgin's share of voice is disproportionately higher than United's who has a larger network more routes, more destinations, more planes (see Figure 3). Southwest Airlines has almost 11 times the followers of United. Both Southwest Airlines and Virgin America have put out 3 times more tweets than United.

Figure 3. Despite Size, Virgin Has Huge Share of Voice

- Sentiment by airline. The low cost carriers appear to have cracked the customer service challenge in social media better than United and other legacy airlines. Virgin America's positive sentiment hovers above 75% positive while Southwest Airlines held at slightly over 70% positive (see Figure 4). United's sentiment shows an inverse with around 26% positive sentiment and 74% negative sentiment. The public tweets posted per follower (between .007 and .027) for United is comparable to Southwest Airlines. Ironically, Virgin America has a lower public tweets posted per follower count, but has higher positive sentiment than United.

Figure 4. Virgin and Southwest Have Overwhelmingly High Positive Sentiment While United's Negative Sentiment Sets It Apart

- Detailed sentiment (positive or negative). The solution automatically creates categories that users can modify or leave as-is for further analysis (see Figure 5). A text preview allows users to quickly scan the comments related to the twitter stress. In United's case, poor sentiment translates into three major areas for massive improvement: customer treatment, flight schedules, and hate airline rounded up the Top 3 negative sentiments.

Figure 5. United's Detailed Negative Sentiment

The Bottom Line: Companies Such As United Airlines Can't Hide In A Transparent World

In this shift from transactions to engagement, social business and customer experience shifts the priorities of major organizations. Organizations must staff, train, and enhance how their front office employees work with prospects and customers in multiple channels. Social media makes everything transparent and any competitor can monitor your company's social presence. Hoping that folks will ignore you if you ignore social media is a sure way to drive negative sentiment for your customer base. While United Airlines may feel insulated by its corporate contracts, expect many individuals to tell their procurement organizations to switch carriers this year as the negative sentiment for United grows. In fact, companies such as United Airlines better wake up to the reality of social media or face an eroding customer base.

Recommendations: Always Start With Listening Before Engagement

All social business projects should start with an analytics strategy. The following advice comes from client best practices in our client research panels:

- Scan your base for correlations to the analog world. Make sure results in social tie have relevance to not only a segment, but also the rest of the customer and prospect base. A industrial ball bearing manufacturer for heavy machinery probably will not find strong correlations and adoption to their FaceBook page.

- Identify new markets by listening in on your competitors' customers. Understand thyself first but understand thy competitors and find out what product categories, vertical markets, geographies, and sentiments are hot.

- Add dimensionality. Take analytics to the next level and aggregate inputs and signals from all source types. Tie back data to existing customer systems.

- Move from insight to action. Determine the next steps once armed with insights. Improve the quality and timeliness of decisions.

- Refine. Remix. Repeat. Identify points of failure. Improve on these areas. Test out new areas with new hypotheses.

Your POV.

Considering social analytics? Are you ready to take the plunge? Tell us how we can assist? Add your comments to the blog or send us a comment at R (at) SoftwareInsider (dot) org or R (at) ConstellationRG (dot) com

Please let us know if you need help with your Social CRM/ Social Business efforts. Here’s how we can assist:

- Assessing social business/social CRM readiness

- Developing your social business/ social CRM strategy

- Vendor selection

- Implementation partner selection

- Connecting with other pioneers

- Sharing best practices

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Related Research:

- Event Report: Lithium Network Conference 2012 #LiNC

- Best Practices: From First To Worst – Continental In A Post United World, Lessons In Next Gen Customer Experience

- Monday’s Musings: Seven Basic Privacy Rights Users Should Demand For Social Business

- News Analysis: Lithium Technologies Adds $53M in Financing

- Monday’s Musings: Balancing The Six S’s In Consumerization Of IT

- Monday’s Musings: A Working Vendor Landscape For Social Business

- Product Review: Google+, Consumerization of IT, and Crossing The Chasm For Enterprise Social Business

- Monday’s Musings: Using MDM To Build A Complete Customer View In A Social Era

- Monday’s Musings: Mastering When and How High End Brands Should Use Daily Deal Sites Such As Groupon

- News Analysis: Salesforce.com Acquires Radian6 For $316M

- Monday’s Musings: Q1 2011 State of Social CRM and CRM From An EMEA Point Of View

- Best Practices: Applying Social Business Challenges To Social Business Maturity Models

- Research Summary: Software Insider’s Top 25 Posts For 2010

- Best Practices: Five Simple Rules For Social Business

- Research Report: Constellation’s Research Outlook For 2011

- Research Report: How The Five Pillars Of Consumer Tech Influence Enterprise Innovation

- Research Report: Next Gen B2B and B2C E-Commerce Priorities Reflect Macro Level Trends

- News Analysis: Jive Fills Warchest, Ready to Battle Enterprise Software Giants And IPO?

- Tuesday’s Tip: Applying The Five Stages Of Adoption Towards SCRM Projects

- News Analysis: Lithium’s Acquisition of Scout Labs Ups The Ante in Social CRM

- News Analysis: Biz360 Acquisition Signals Attensity Group’s Move Into Social CRM

- Monday’s Musings: Avoiding Failure In Social CRM Projects Requires Ecosystem Coordination

- Research Report: The 18 Use Cases of Social CRM – The New Rules of Relationship Management

- News Analysis: Siperian Acquisition Vaults Informatica Into An MDM Leadership Position

- News Analysis: Jive and Radian6 Partner – Great For Business, But Could Fragment IT Systems

- Event Report: Salesforce.com Pushes Social CRM Technology — But Don’t Expect Companies To Be Successful With Tools Alone

- Monday’s Musings: Why Every Social CRM Initiative Needs An MDM Backbone

- Personal Log: Altimeter Group – Helping Organizations Bridge The Technology Obsolescence Gap

- Monday’s Musings: 10 Essential Elements For Social Enterprise Apps

Reprints

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales .

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy, stay tuned for the full client list on the Constellation Research website.

* Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Copyright © 2001 – 2012 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Customer Experience!

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang